TOP 7 trading styles, which one are you?

The timeless adage, "buy low, sell high," forms the bedrock of trading. While this principle remains constant, the strategies employed to capitalize on price fluctuations vary widely. This article delves into the top 7 trading styles, exploring their unique characteristics, risk profiles, and suitability for traders.

The Two Core Approaches

Before diving into specific styles, it's essential to recognize the two fundamental approaches to trading:

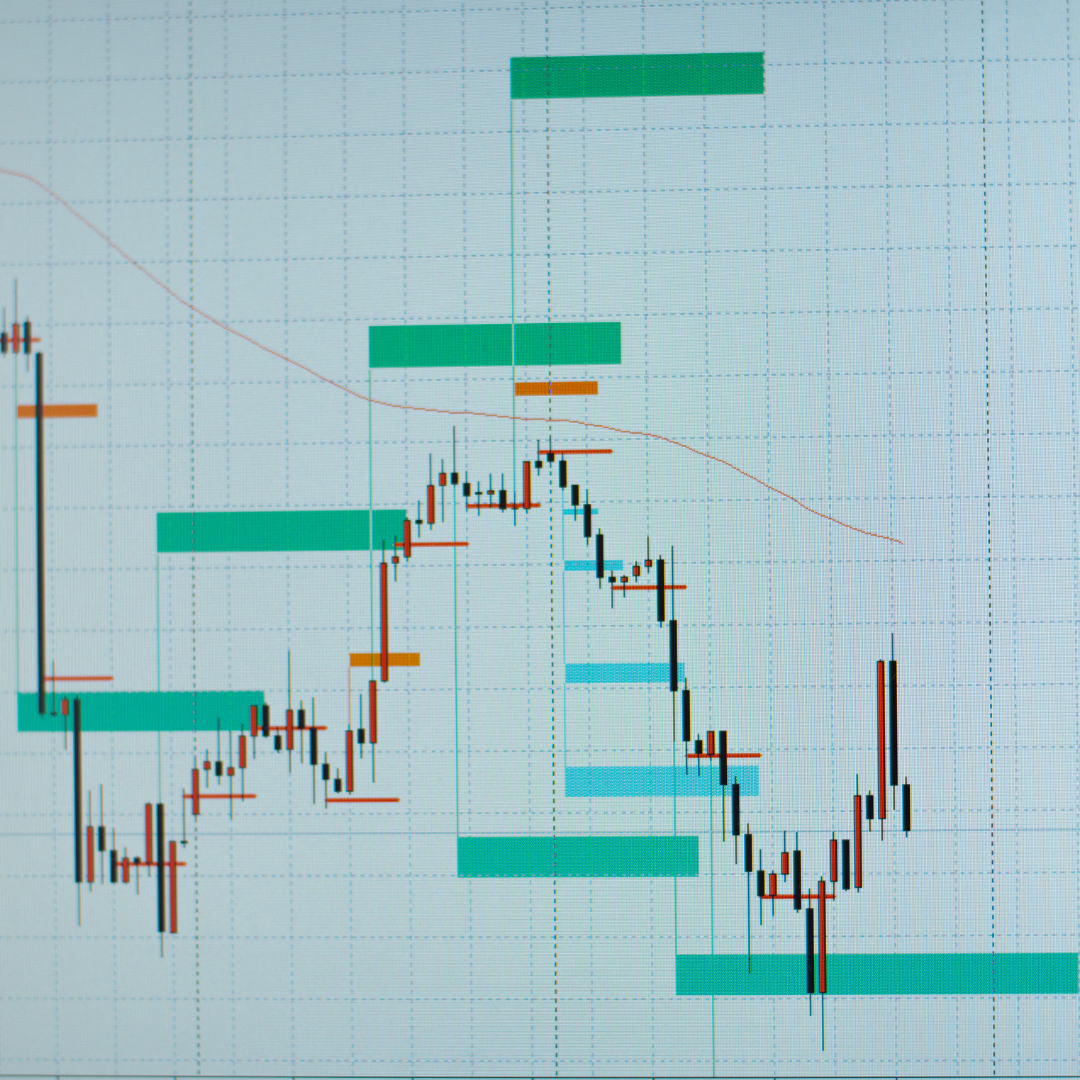

Technical Analysis

This method involves studying historical price data to identify patterns and trends. Technical analysts utilize a variety of tools and indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands (amongs others), to predict future price movements. They believe that past price action can provide clues about future price direction.

Fundamental Analysis

This approach focuses on evaluating the intrinsic value of an asset by analyzing economic, financial, and industry-specific factors. Fundamental analysts examine factors like earnings reports, balance sheets, debt levels, and industry trends to determine whether an asset is undervalued or overvalued. Contrary to what most people think, fundamental analysis is used for any asset class, because any asset, wheter it is gold or Apple, has some ground to be analyzed upon.

The Top 7 Trading Styles

Day Trading

- Short-term focus: Buying and selling within a single trading day.

- High-frequency trading: Requires quick decision-making and a strong understanding of market dynamics.

- Technical analysis-driven: Relies heavily on charts and indicators.

- High-risk, high-reward: Potential for significant profits, but also substantial losses.

Swing Trading

- Medium-term focus: Holding positions for several days to a few weeks.

- Balance of technical and fundamental analysis: Combines both approaches to identify entry and exit points.

- Moderate risk: Lower risk profile compared to day trading.

- Consistent returns: Potential for steady profits over time.

Position Trading

- Long-term focus: Holding positions for weeks, months, or even years.

- Fundamental analysis-driven: Relies on in-depth research and analysis of underlying assets.

- Lower risk: Lower risk profile compared to short-term trading styles.

- Significant returns: Potential for substantial profits over the long term.

Scalping

- Extremely short-term focus: Making numerous small profits on a large number of trades.

- High-frequency trading: Requires lightning-fast execution and advanced trading systems.

- Technical analysis-driven: Relies heavily on charts and indicators.

- High-risk, high-reward: Potential for significant profits, but also substantial losses.

Algorithmic Trading

- Automated trading: Uses computer programs to execute trades based on predefined rules and algorithms.

- High-frequency trading: Relies on speed and precision.

- Technical analysis-driven: Relies on complex algorithms to identify trading opportunities.

- Reduced emotional impact: Eliminates human error and biases.

News Trading

- Event-driven trading: Capitalizes on market reactions to news releases, economic indicators, and geopolitical events.

- High-volatility environment: Requires quick decision-making and a strong understanding of market news.

- Potential for significant profits: Can generate substantial returns, but also significant losses.

Bonus: Automated Trading

Automated trading, also known as algorithmic trading, leverages computer programs to execute trades based on predefined rules and algorithms. These algorithms analyze market data, identify trends, and execute trades at lightning speed, often surpassing human capabilities.

Benefits of Automated Trading:

- Speed: Algorithms can execute trades faster than humans, allowing traders to capitalize on fleeting opportunities.

- Reduced Emotional Impact: By removing human emotions from the equation, automated trading can help mitigate impulsive decisions.

- Consistency: Algorithms can consistently follow predefined strategies, reducing the risk of inconsistent behavior.

- Efficiency: Automated trading systems can monitor multiple markets and execute trades 24/7.

Challenges of Automated Trading:

- Complexity: Developing and maintaining sophisticated algorithms requires advanced programming skills.

- Market Volatility: Sudden market events can disrupt the effectiveness of algorithms.

- Technological Risks: System failures and cyberattacks can pose significant risks.

Choosing the Right Style

Selecting the optimal trading style involves considering various factors:

- Risk Tolerance: Assess your comfort level with risk.

- Time Commitment: Evaluate the time you can dedicate to trading.

- Financial Goals: Define your short-term and long-term financial objectives.

- Trading Skills and Knowledge: Assess your level of experience and expertise.

By carefully considering these factors, you can identify a trading style that aligns with your goals and risk tolerance. Remember, there's no one-size-fits-all approach. Experimentation and continuous learning are key to refining your trading strategy.

Additional Considerations:

- Emotional Control: Develop emotional discipline to avoid impulsive decisions.

- Continuous Learning: Stay updated on market trends, economic indicators, and new trading strategies.

- Risk Management: Implement robust risk management techniques.

- Diversification: Spread your investments across different assets.

- Professional Guidance: Consider seeking advice from experienced traders or financial advisors.

By understanding these trading styles and applying sound risk management principles, you can increase your chances of achieving long-term success in the financial markets.