Crypto Bot Trading: Mastering Automated Trading on TradingView

Key Takeaways

- An automated trading platform leverages the power of algorithms to execute trades on behalf of the user, providing unmatched efficiency and precision to trading activities. It is crucial for traders who want to reduce the need for manual intervention and take advantage of market opportunities quickly.

- In fast-paced markets, TradingView can act as a powerful tool for automated trading. It’s rich with advanced customizable charts and connects natively to all of the major platforms, providing an incredible user experience and unmatched strategic flexibility.

- Before implementing trading automation, it’s important to have a clear trading strategy in place. Utilizing TradingView's Algo Strategy Builder (pinescript) can streamline the process, while setting alerts ensures timely execution of trades.

- Trading bots on TradingView help users become significantly more efficient and accurate. This saves users time, so they can focus more time on testing and perfecting their strategies.

- Even with a winning automation, successful automation requires ongoing oversight and updating of one’s strategy. It requires strong risk management practices and precise timing on the rollout.

- Pairing multiple platforms together for automation increases your strategy adaptability. It unlocks a number of powerful features that can significantly improve your trading performance.

Automated trading on TradingView provides a simple, effective way to manage trades in an efficient manner. TradingView provides professional-grade charting features and automated strategies. Equipped with these features, we are able to execute trades in a flash and with laser-like precision.

By adopting this approach, we minimize the amount of hands-on tracking required while freeing up time to spend on improving our strategies. Automated trading allows us to be nimble and responsive to market developments so we can maintain a smooth and efficient trading operation.

It’s an invaluable asset in today’s breakneck market.

What is Automated Trading?

1. Define Automated Trading

Automated trading, or algorithmic trading, is an approach to financial markets in which computer programs automatically execute trades according to a detailed set of instructions, or algorithm.

These algorithms can be as simple as a few lines of code or as complicated as elaborate statistical models. Some of them even with thousands of data points processed!

Automated trading determines when to buy or sell without human involvement. Automated trading works very differently, in that it depends entirely on programmed logic as opposed to human trading.

This provides unparalleled speed and productivity in trade execution. As a result, it’s responsible for more than half of the trading volume in our financial markets.

High precision and repeatability is achieved through data processing and algorithmic execution. Even for human traders, it’s difficult to obtain these outcomes on a regular basis.

2. Explain Its Importance

Automated trading is the most effective way to remove emotional biases from the trading process. This safety feature prevents traders from making rash or emotional moves.

By following the letter of the strategy’s logic, automated trading can make transactions without the bias of human emotion. This functionality is especially important in today’s frenetic market landscape, where time and repeatability is of the essence.

Automated trading systems have the ability to analyze and process massive amounts of data at lightning speeds. This powerful capability provides users an immense competitive advantage.

The industry is booming and is expected to exceed the $18.8 billion market value by 2024. This impressive growth especially underscores the rising demand for these systems and their essential role in today’s complex trading environment. In a world were this technology will dominate, those who did not adapt will be vulnerable.

3. Discuss Common Uses

Automated trading systems are widely used by both institutional and retail market participants to execute trades automatically when market conditions meet their pre-defined criteria.

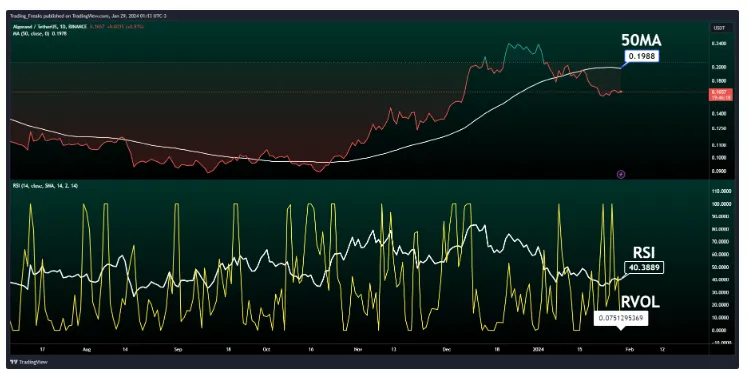

Such conditions can be price levels, certain market occurrences, or strategies developed with TradingView’s Pine Script. For example, investors could use automated trading systems to automatically execute trades when certain technical indicators hit specified thresholds.

This advanced ability to execute trades based on complex criteria helps make sure sophisticated trading strategies are implemented based on the most consistent, accurate rules.

Tools such as TradingView and platforms like Pinetrader.io give retail traders the tools to stay powerful. They merge critical analytical insights with high-speed automated execution to improve trading efficiencies across the board.

The technology’s robust application has reached many different markets, showcasing its flexibility and efficacy.

Role of TradingView in Automation

1. Explore TradingView Features

That’s where TradingView comes in, with features that are flexible, powerful, and formidable. Pine Script is one of the best-featured automation tools on the market. It allows us to quickly create tailor-made automated trading strategies.

This user-friendly scripting language makes it easy for beginning and expert traders alike to code straightforward and complex strategies. As a result, with more than 60 million users around the world, TradingView enables many unique applications.

Through its compatibility with third-party tools like Capitalise.ai, we can easily plug in to create automated trading bots. This means we can customize them to better serve our needs.

2. Discuss Integration Options

TradingView’s automation integration capabilities make it a powerful tool. We can integrate with Pinetrader.io Algo Automation tool.

This move lays the groundwork for a powerful, seamless bridge between TradingView’s analytical prowess and Pinetrader's automation tools. Together, this incredible combination of creative freedom and power makes for exciting possibilities, letting us automate complicated strategies with pixel-perfect precision.

Together with automated action on platforms like Capitalise.ai, TradingView’s alerts make it possible to automate the entire trading process.

3. Highlight User Benefits

The advantages of implementing TradingView with automation are significant. By integrating its charting and analysis features with execution tools like MetaTrader 5, we can craft a sophisticated automated trading system.

This type of system makes the trading process much easier and improves efficiency. As the market for automated trading itself is positioned to grow substantially, TradingView’s role stands to become even more critical.

It’s a unique platform that meshes sophisticated analytical capabilities with automated execution. This provides us with a competitive advantage in the fast-paced, rapidly changing trading environment.

Creating and Automating Strategies

1. Define Your Trading Strategy

We begin by providing a very transparent description of our trading strategy. By coding our strategy with Pine Script on TradingView, we’re able to clarify the logic behind our trades. This step is particularly important because automated systems follow logic completely, removing emotion from the decision-making process.

For instance, we define our strategy directly in the code. If the stock’s moving average goes above a certain level, we’ll purchase. Automation makes sure that trades are executed according to this initial logic no matter what.

2. Use Algo Strategy Builder

Pinetrader.io Strategy Builder is the quickest and easiest way to automate our trading strategies. It’s free and democratizes access by closing the gap to algorithmic trading. Today, high-frequency—or algorithmic—trading constitutes more than half of all trades in the market.

With this software at our fingertips, we can automate development of complex strategies with relative ease. Its flexibility allows us to pivot strategies when market conditions change, something that’s critical to maintaining a competitive edge.

3. Set Alerts and Instructions

Once we had defined and built our strategy, we created alerts and directives to automatically track its performance. This means setting up alerts to help flag for us when certain things are true.

Even with automation, daily oversight makes sure our plan executes the way we want it to. That proactive approach allows us to pivot quickly to make the necessary changes.

Benefits of Trading Bots on TradingView

1. Increase Efficiency

TradingView’s automated trading systems allow traders to automate their trading process by executing trades automatically based on pre-defined trading strategies. This method removes emotional factors, which are usually the cause of spontaneous moves.

With trading bots, traders can automate the process and capture opportunities efficiently. Arbitrage bots, for example, can quickly buy Bitcoin on one exchange and sell it on another exchange when a price difference occurs. This strategy would allow you to capture a profit of $200 on each Bitcoin you sell.

2. Enhance Accuracy

Automated trading helps to improve accuracy by giving traders access to historical price data and technical indicators. This makes it possible to test any strategy in detail and guarantees that every trade is executed perfectly.

TradingView’s platform complements this by giving users an option to execute strategies without emotional weight, ensuring consistency in trade execution through emotional detachment.

3. Optimize Time Management

With automated trading, you don’t have to spend all day glued to the markets. The beauty of the bots is traders can spend time working on other parts of their business, while the system executes trades in real-time.

This strategy, in combination with having the confidence of Growlonix’s support, is particularly invaluable when breaking ground in the fast-paced world of crypto markets.

Tips for Successful Automation

1. Monitor and Adapt Strategies

Our success in trading is based a lot on the ability to pivot strategies where the market is going. With help from the Algo Strategy Builder, we can sharpen our focus, making sure that we are in lockstep with today’s market conditions.

Automations and tools such as TradingView and SpeedBot supply immediate notifications, giving us the ability to stay nimble while not chained to screens. Automation takes the emotion out of trading, following the logic every time.

Platforms such as Tickerly make it possible for us to connect our TradingView account and have trades executed automatically based off our own customized scripts, automating the process.

2. Manage Risks Effectively

Effective risk management becomes even more important in automated trading. With billions of dollars traded in a matter of seconds, the tools we choose will help determine the success or failure of our strategy.

Automated systems can churn through massive amounts of data at lightning speed, making trades at a rate no human could match. Even with automation, it’s still super important to check our trading plan every day, ensuring it’s plan still works today.

3. Evaluate Automation Timing

When you automate is almost more important than how you automate. Considering that 60-75% of trading volume is due to algorithmic trades, trading to their rhythm by executing our automation can give us a performance boost.

Automated systems trade with an unmatched level of speed and discipline, often the difference between being competitive or missing out in such a high-speed market.

How to Automate TradingView Strategy?

1. Choose the Right Tools

Whether you’re automating your TradingView strategy or not, choosing the right tools is an important first step. TradingView, combined with Pinetrader Builder, creates a powerful, adaptable platform to customize and automate trading.

This combination gives traders the flexibility to adjust strategies as market conditions change. For example, having well-defined criteria for entering and exiting trades is important prior to automating. This helps to ensure that trades are executed strictly according to your logic, eliminating emotional decision-making.

Being able to adjust these parameters when conditions change keeps emotion out of the decision making.

2. Implement Step-by-Step Process

Approach automation smartly, starting with a disciplined trading plan. This will involve defining the strategy’s rules, such as when to enter and exit trades, risk management, and more.

This is where automation software comes in—it can execute your rules with perfect accuracy. Even if you automate your trading strategy, it’s still critical to monitor your plan on a regular basis. This helps keep the strategy optimized towards your goals and the current market condition.

3. Test and Backtest Strategies

Testing is an important step in determining the potential effectiveness of the strategy. Backtesting your Pine Script against historical data lets you know how well it would have done in the past.

With 60-75% of market volume attributed to algorithmic trading, reliability is paramount. By 2024, the automated trading market is projected to be $18.8 billion, demonstrating its increasing importance.

Through consistent testing, we can refine and adapt strategies to achieve the best possible results.

Why Combine Platforms for Automation?

1. Explore Combined Benefits

Pairing TradingView and Pinetrader.io gives traders a complete and powerful trading platform. TradingView traders are familiar with TradingView for their charting and technical analysis superiority. It’s currently the most popular trading platform with more than 50 million active traders worldwide.

Pinetrader Automation for Tradingview introduces advanced automation and execution capabilities. Together, these platforms provide traders with the best of both worlds, greatly improving their capacity to operate in increasingly complicated markets. By combining these platforms, traders can take advantage of TradingView’s robust analytics.

This, integrated with Pinetrader.io for MT5 automated execution by design, provides a seamless and improved trading experience.

2. Enhance Strategy Flexibility

When we integrate these platforms, traders get more freedom to pursue their strategies. TradingView is wonderful for strategy development. Via PineConnector, trading signals are sent instantly.

This lowers latency and delivers the highest precision in trade execution. With MT5 integration, the gap between planning and execution is closed. Traders can use the platform to automate more complex strategies, reducing the degree of manual intervention and improving trading efficiency.

That flexibility is a huge asset too, in a quickly evolving trading landscape.

3. Leverage Advanced Features

Combining TradingView and Optimus Flow makes these powerful features work for you, unlocking next level trading performance. Automated systems help traders to act faster and more accurately. Indeed, more than half of traders currently use such systems to maximize their success, further emphasizing the critical importance of this technology.

This seamless integration enables real-time execution. Traders receive highly sophisticated tools, enabling them to make faster, more informed decisions while maximizing their efficiency and effectiveness to achieve superior outcomes.

Conclusion

Automated trading on TradingView presents an exciting opportunity to simplify and improve trading strategies. It reduces the grunt work and allows us to focus on better decision-making. Trading bots on TradingView offer us the speed and consistency we need to react to market changes quickly and efficiently. By integrating these platforms, we open up even greater possibilities for more intelligent, efficient trading.

We hope your path to successful automation starts with learning and adopting these best practices. With continuous learning and adapting to tools like TradingView, we can open a whole new level of opportunity in our trading.

Let’s adopt this technology and take our trading results from good to great. Discover the power of automated trading with TradingView for yourself and find out how it can benefit you. See the advantages for yourself and chart a course to a better trading experience.