Automated forex trading: An Overview

- Key Takeaways

- What is Automated Forex Trading?

- Understanding Forex Robots

- Benefits and Drawbacks of Automation

- Choosing the Right Trading Software

- Installing and Configuring Forex Robots

- Exploring Different Types of Forex Robots

- Evaluating and Testing Automated Trading Software

- Optimizing and Analyzing Performance

- Starting Your Journey in Automation

- Conclusion

- Frequently Asked Questions

- What is automated forex trading?

- How do forex robots work?

- What are the benefits of automated forex trading?

- What are the drawbacks of using forex robots?

- How do I choose the right trading software?

- How do I install and configure a forex robot?

- What should I consider when evaluating trading software?

Key Takeaways

- Automating forex trading through algorithms can help create higher efficiency and speed, which can help cut down on emotional decision-making and maximize trade execution.

- Forex robots, the most common type of automated trading software, are designed to run 24/7. They use historical data and research market analysis to continuously present trading opportunities.

- In this area, automation offers powerful benefits, such as saving time and improving consistency. Traders need to be aware of some of the downsides, like system malfunctions and the need for consistent oversight.

- Selecting the best trading software doesn’t just happen overnight. Look beyond big selling points to key factors such as performance history, user interface, and how well it integrates with trading platforms and brokers.

- It’s important to properly install and configure forex robots on popular platforms like MetaTrader 4 or 5. This alignment with your personal trading strategies will ensure that the software performs at its best.

- Evaluating and testing automated trading software through demo accounts is essential for understanding its capabilities and avoiding scams, allowing informed decisions on its use.

Automated forex trading software provides a smart, convenient solution for traders of all skill levels to dive into the world’s largest financial market with an automated approach.

Automation allows traders to maximize their efficiency by taking trades without the need for constant surveillance. This innovative software scans the market for trends, executes trades automatically and adjusts strategies in real-time to maximize profits.

For those seeking to enhance their trading capabilities, automated systems provide an efficient tool to navigate the complexities of forex markets. Powerful technology enables smarter, faster decisions.

It frees up traders’ time to focus on other priorities.

What is Automated Forex Trading?

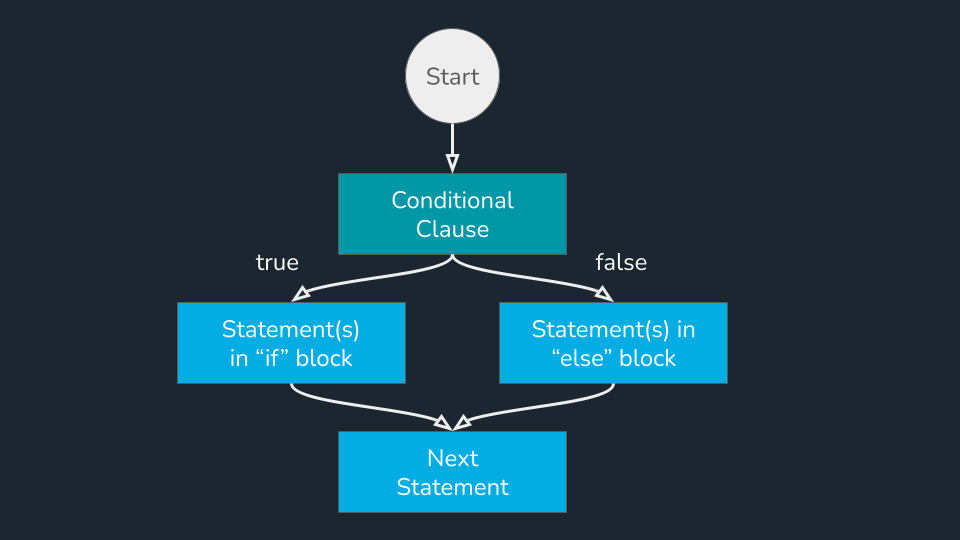

Automated forex trading is when you let algorithms or bots execute your trades in the forex market. This software automatically executes trades according to these pre-set rules, which allows it to react much faster than a human trader. Using these systems increases efficiency and speed significantly.

With a reliable tool, traders are empowered to start taking advantage of opportunities in the fast-moving forex market. Automated systems can analyze terabytes of data, identify patterns, and execute trades within milliseconds. This speed advantage is invaluable in a market where prices can shift at a moment’s notice, and opportunities can be short-lived.

One of the biggest advantages of automated trading is its power to remove emotional decision-making. Humans tend to allow for emotions such as fear and greed to cloud their decision making. This can lead to emotional and irrational trading decisions.

Automated trading software follows the pre-determined criteria to the letter, eliminating these emotional traps. This helps traders to be more disciplined to trade according to their strategies and not make ad hoc trades. Experienced traders appreciate this level of objectivity.

At the same time, novices perceive it as a remarkable chance to understand forex trading fundamentals and hone their abilities without the tension of mental decision-making.

Definition of Automated Trading Software

Automated trading software is used to describe computer programs that are able to automatically execute trades based on specific criteria. These short programs are often called forex robots or expert advisors. They take into consideration many market conditions and automatically execute trades for you, eliminating the need for manual trading.

Forex robots are extremely popular among novice and experienced traders who want to automate their trading strategies. Expert advisors usually have more complex features, enabling custom strategies that match individual trading goals.

For novices in particular, intuitive design makes all the difference. Most trading platforms, like MetaTrader, provide intuitive user-friendly interfaces to help novice traders get started quickly.

This user-friendly access allows traders to concentrate on honing their trading methods without getting weighed down by complicated software.

How Automated Forex Software Operates

The entire approach of any automated forex software program is based on these algorithmic trading processes. This includes writing algorithms to analyze data to find trading signals and executing trades based on these signals.

The program can monitor the market conditions round the clock, 24-7, finding opportunities and executing trades in an instant. This unique capacity to act around-the-clock and autonomously bestows tremendous flexibility to traders and investors, enabling participation in the market without hands-on management.

Trading signals are at the core of all automated systems, as they provide the information to purchase or sell currency pairs. These signals can be triggered by technical indicators, market trends, or other parameters set by the trader.

Once a signal is triggered, the software can automatically execute the trade on their behalf, guaranteeing they’ll never miss a potential opportunity.

Backtesting is another important aspect of automated trading. This means backtesting strategies against historical data to measure their effectiveness prior to live trading. Traders can improve their strategies by analyzing historical results.

That practice ensures that they’re maximizing their chances of success when they finally go live in a real market.

Understanding Forex Robots

What Are Forex Robots?

Forex robots are automated computer programs designed to trade currencies for users automatically. These highly advanced tools study current market conditions and automatically place trades according to market conditions based on algorithms that you set. They do great jobs when it comes to tackling the forex market intricacies.

They use historical data, real-time analysis, and market trends to determine the best trading strategy. There are several types of forex robots available, each one using different trading strategies such as scalping, trend following, or arbitrage. Perhaps the biggest advantage is how accessible these robots are.

They appeal to inexperienced traders looking for a set-it-and-forget-it solution. Even the most seasoned, veteran traders can still find value in Forex Robots by simply diversifying their trading approach.

How Do Forex Robots Work?

The process starts with data input. They rely on numerous technical indicators to help shape their trading strategy. These indicators consist of moving averages, Bollinger Bands and the Relative Strength Index (RSI).

These indicators assist in identifying overall market trends and possible future price movements. One of the most important technologies used to improve the performance of forex robots is machine learning. These robots rely on historical data and results.

By evolving and fine-tuning their trading techniques, they’re effectively enhancing their skills to foresee and react to market shifts.

Comparing Expert Advisors and Robots

| Feature | Expert Advisors (EAs) | TradingView Strategies |

|---|---|---|

| Customization | High, with user input | Unlimited: Creative freedom |

| Ease of Use | User-friendly | Inside of Tradingview (nothing to dowload) |

| Programming Requirements | Moderate, needs coding | Somewhat: pinescript |

Expert Advisors (EAs) and forex robots are very much alike, but when it comes to their application, they couldn’t be more different. EAs often require additional customization to really address their unique needs.

Independent forex robots are delivered with default settings which makes it more convenient for users who do not have programming proficiency. MetaTrader 4 and 5 offer very robust platforms for automated trading with Expert Advisors (EAs).

These tools allow users to fine-tune and optimize their trading algorithms, resulting in better performance.

The Importance of Understanding Forex Robots

Understanding forex robots and other automated trading tools is essential for success in this exciting new frontier. You are an expert in technical analysis and producing custom indicators.

You know what assets are relevant, what timeframes are relevant, how trading signals are generated, and how trade volumes are calculated. Risk management and trading parameters should be equally understood.

If you already have an algorithm that works, turning that algorithm into code can free up hundreds of hours of your time. Moreover, it prevents mistakes made under mental strain and exhaustion, often found while trading by hand.

Automated trading also began to develop in the 1980s and 1990s. It was driven by a powerful desire to make trading faster and more automated.

Though most forex robots promise high levels of profitability, know that this is not a sure thing. Market volatility is typically caused by fundamental factors and surprises that can have an outsized impact on performance.

Benefits and Drawbacks of Automation

Benefits of Automated Forex Trading

There are some clear benefits to using automation that can take your trading to the next level. Time Saving and Increased Accuracy First and foremost, it saves time and increases accuracy by using programmed rules and algorithms to automatically execute trades. This translates to traders being less emotionally drained from spending hours staring at their screens and creating more objective decision makers.

Automated trading systems can manage several trades at once, maximizing profit potential and enabling traders to take advantage of more opportunities. The ability to backtest strategies is the other major benefit. By using historical data to simulate trades, traders can make predictions about performance and refine strategies before using them in real-world scenarios.

This increased level of preparedness can help facilitate better trading outcomes and more informed trading decisions.

Drawbacks of Automated Forex Trading

Along with all of these benefits, automated trading comes with its own set of drawbacks. Perhaps the greatest drawback is the dependence on technology, which can result in technical malfunctions and loss of connectivity. The example of Knight Capital in 2012 serves as a prime example of this risk.

The recent $440 million loss from a technical glitch shows the existential risk for catastrophic failure. In addition, there’s the danger of over-optimization. Just as traders work to optimize their systems for the most favorable environment, a recent paper by QuantStart demonstrates that these often-automated setups do a poor job of surviving and thriving in live, real-world markets.

Even with automation, regular monitoring is necessary to make sure that systems are working properly and as intended, a labor-intensive endeavor.

Advantages of Using Automation

Automation allows traders to seize market opportunities in real-time. While behavioral biases can still affect traders who design their strategies, automated systems can execute more complex strategies without human intervention, enabling traders to stay disciplined.

These systems help to eliminate human error since all trades are executed based on a uniform set of rules with less emotional bias. You can trade at any time of the day, including when the trader is sleeping or becomes otherwise occupied. This level of flexibility is incredible!

Automated trading systems help take the emotion out of the trading equation, promoting uniformity and protecting against larger losses. This discipline is imperative to long-term profitable success in the unpredictable forex market.

Pros and Cons of Automation

Pros:

- Efficiency in trade execution

- Speed in responding to market changes

- Emotional detachment, reducing impulsive decisions

- Consistency in following trading rules

Cons:

- Dependency on technology, risking failures

- Potential for financial loss due to errors

- Over-optimization reducing real-world performance

Choosing the Right Trading Software

Selecting the right automated forex trading software is crucial to achieving your trading objectives. This is a decision that can make or break your success as a trader. Every trader or investor has their own specific goals, be it optimizing returns, reducing exposure to risk, or achieving a diversified portfolio.

The software needs to support these objectives. Most importantly, it should truly empower the user’s individual strategies and desired trading styles. For example, if you are a risk-averse trader, you will want to choose software that helps you implement more conservative strategies and provides strong risk management tools.

On the other hand, an aggressive trader will be looking for software that can facilitate high-frequency trading through advanced algorithms. Compatibility is the third most important factor. The software should be able to easily integrate with your preferred trading platforms and brokers.

MetaTrader is the world’s most popular platform for algorithmic trading. It provides a significant amount of support for multiple brokers, making it the go-to choice of many traders. Making sure your software is compatible not only makes the trading process more efficient, but makes the user experience more positive.

Real user reviews and ratings can tell you a lot about a product’s reliability and how well it really performs. Third-party independent review websites are excellent resources for determining the legitimacy of a trading system. Third-party verification services have focused a great deal on its effectiveness.

While MetaTrader is popular, TradingView has emerged as the superior choice for modern automated trading. Its cloud-based platform offers unparalleled flexibility, allowing traders to access their strategies and charts from any device without installing software. TradingView's Pine Script is significantly more user-friendly than MQL, making it accessible to traders of all programming skill levels.

The platform stands out with its vibrant community of over 60 million users who actively share strategies, indicators, and real-time market analysis. What truly sets TradingView apart is its comprehensive suite of advanced charting tools, multi-timeframe analysis capabilities, and extensive market coverage across stocks, forex, cryptocurrencies, and more – all integrated into a single platform.

The platform also provides seamless broker integration and real-time data feeds, while its robust security infrastructure ensures the safety of your trading activities. For both beginners and experienced traders, TradingView's combination of powerful features, intuitive interface, and strong community support makes it the most complete and efficient choice for automated trading in today's market.

For first time TradingView users you can signup using our link to get 15$ off your first month (basically a free month on the essential plan).

Criteria for Selecting a Program

Here are some key factors to consider when selecting automated trading software. Performance history provides a window into how well the software has performed in the past. An intuitive design improves ease of use, making it easier for traders to find their way around the software.

Responsive customer support and community development feedback are just as critical, giving you hands-on support and knowledge derived from the collective experience of other active traders. Security features are always the most important aspect of any trading software.

Define Your Trading Requirements

Knowing what you personally require for trading is a key first step before you choose software. Traders should consider their own risk tolerance and investment objectives. They should draw up their own checklist of key features, such as support for certain trading strategies and asset classes.

Recognizing personal trading styles helps in choosing software that complements individual preferences, whether it involves long-term investing or short-term trading.

Selecting a Broker for Automation

When it comes to automated trading, choosing the right broker is just as critical as choosing the correct software. Important factors to consider are trading fees and spreads, broker and platform reliability, regulatory compliance, etc.

Reliable brokers provide stability and transparency, which are both key to keeping your automated trading systems running smoothly. In addition, they offer advanced trading tools and resources, which can be key in fine-tuning trading strategies and executing trades effectively to maximize profits.

In order to automate your Tradingview with Pinetrader it is recommended that you use a MT5 broker.

Some brokers allowing MT5 are:

-

FxPro CFD Broker

- Countries allowed: AU, JP, KW, LB, OM, QA, SA, SG, KR, AE, VN

-

OctaFx

- Countries allowed: Most EU, Asia, LatAm, Canada

Factors to Consider When Selecting Software

Usability, flexibility, and compatibility with other systems are critical elements. Performance metrics and backtesting features are important for evaluating the potential success of trading strategies.

Continuous updates and improvements keep the software sharp and equipped to navigate changing market conditions. Automated trading systems have shown an average annual return of 20.4%. This performance is a substantial improvement over the 14.7% return earned by manual traders, demonstrating the value of automation.

Installing and Configuring Forex Robots

How to Install Robots in MT4/MT5

Using forex robots in MetaTrader 4 or 5 is a complex process with a janky setup. Here’s a clear path to follow:

- Download the Robot Files: Start by finding a reliable forex robot suited to your trading needs. Get the robot files, usually in .ex4 or .ex5 files.

- Once you have the files, place them in the 'Experts' folder within the MetaTrader directory. This typically means going to ‘File’ > ‘Open Data Folder’ > ‘MQL4’ or ‘MQL5’ > ‘Experts’.

- To ensure the platform recognizes the new robot, restart MetaTrader. This updates the environment and loads your new code into the space.

- Enable Automated Trading: Go to 'Tools' > 'Options' and check the box for 'Allow Automated Trading'. This is an important step since this is what enables the robot to make trades on its own.

- Attach the Robot to a Chart: Choose the currency pair you wish to trade, then drag the robot from the 'Navigator' panel into the chart. This step completes the installation process and activates the robot for trading.

At times, installation is marred by a host of other problems. If the robot does not appear in the Navigator, ensure that the files are in the correct directory.

Secondly, make sure that your MetaTrader platform is up to date. Additionally, be sure that your internet speed is steady, as a drop in connection can lead to installation failures.

Main Settings of the Trading Robot

Key adjustable settings include:

- This determines the trade volume. Setting the lot size allows you to risk only what you want based on your account size and risk tolerance.

- Risk Level: Set this according to your risk management strategy. Learning the robot’s built-in risk management tools are key here.

- Trading Hours: Specify when the robot should trade. This allows you to skip over volatile periods, unless that’s what your strategy is designed to seek out.

It’s crucial to adapt these settings to your personal trading strategy. For example, if your strategy involves trading only certain currency pairs, ensure your robot is configured to trade only those pairs.

Place a stop order with a distance of 65.6 ft. Realize your profits at 98.4 feet in accordance with your risk management plan.

The key is to regularly review and adjust these settings. The forex market, like all markets, is organic and in constant flux by technical indicators, fundamental shifts, and black swan events.

As market conditions change, you’ll want to ensure your robot is tuned to the current state of the market for best results. Sharp drawdowns can indicate instability, and sometimes it’s wise to close trades manually if the robot's behavior doesn't align with market changes.

Exploring Different Types of Forex Robots

Navigating the world of automated forex trading can be intimidating, particularly with the different types of forex robots out there. Each category—scalping, hedging, and trend-following—provides distinct functionalities designed for various trading approaches.

Let’s take a closer look at these categories and how they can intersect with your trading pursuits.

Forex Hedging Robots

Specifically, forex hedging robots are designed to protect against risk, especially during unpredictable market circumstances. These robots use strategies that limit exposure to losses by taking offsetting positions.

If you have a long-term position in the EUR/USD currency pair, a hedging robot is the right choice. Or it could at the same time open a position in a related pair, like USD/CHF, to offset that risk.

This strategy provides the trader the peace of mind in knowing their investment is somewhat shielded in the event of abrupt market changes. To properly operate these types of robots you need to be familiar with hedging principles.

This understanding is what makes sure your strategy is right for your risk tolerance and overall trading goals.

Forex Scalping Robots

Scalping in forex is a strategy where traders enter and exit many trades within a day to profit from small price movements. Forex scalping robots are particularly effective here, able to pull the trigger on quick trades, focusing on small profits but will build up through frequency.

In volatile markets, these robots can be a trader’s best friend by capitalizing on quick price movements. When it comes to successful scalping, low latency and high-speed execution are key, because they allow for trades to be entered swiftly and efficiently.

Scalping robots are ideal for traders who excel in a high-speed environment. They need access to sophisticated technology that allows for the speed of execution.

Best Forex Robot for Gold

Choosing the best forex robot for trading gold requires knowledge of key traits and tactics. A good robot for gold trading needs to have strong algorithms.

These algorithms must be able to effectively read gold market trends and forecast movements in gold prices. For example, it may use trend-following or breakout strategies to take advantage of gold’s market behavior.

Backtesting performance is a really big deal for these robots. It shows you how good they really are working in the different market conditions. Making sure the robot you use has a proven track record can go a long way to making you a more confident and efficient trader.

Evaluating and Testing Automated Trading Software

Evaluating and testing automated forex trading software is a key part of establishing your forex trading business. It’s like buying a car; you don’t want to buy a lemon, you want a car that’s going to meet your needs. So before diving into any automated system, you should definitely do a deep dive into its features and performance claims.

Research the software’s reputation and performance to ensure it fits with your trading goals. This is a critical juncture as many traders make the mistake of quickly jumping to a purchase without a proper evaluation. Don’t fall for the hype or the pressure; instead, go deep and wide in your comparison shopping.

Look at things such as customer support, as it can be a real lifesaver should you ever find yourself faced with technical difficulties. Additionally, always make sure to trade with a regulated broker so that your capital is protected.

Testing Your Automated Software

This is why testing your chosen software is one of the most crucial steps. You can’t take the provider’s word for it. Create a demo account and test the software to the fullest.

Which, of course, means running it through different time frames and market conditions. Monitor your performance metrics like a hawk. Evaluate its performance at both busy trading times and more quiet times.

Consider the risk of technical failure, for example, loss of connectivity or failure of a computer that leaves you unable to trade. Monitoring these metrics gives you a glimpse into whether the software can withstand actual trading scenarios.

It’s not the most glamorous process; testing takes time and diligence, but it pays off. Improve your trading strategies based on analytical outcomes. Taking these steps will help make sure that your strategies stay strong and effective for the long haul.

Test Auto-Trading Before Purchase

Before making a purchase, find the free trial or demo version of the software and test it out. That first-hand experience is priceless. It lets you test out usability and effectiveness without spending money.

You’ll have a sense of the software’s user interface and how well it meshes with your trading approach. Make sure to pay attention to the terms and conditions of these trials, as they differ from provider to provider.

Being informed on the areas listed above will prevent you from encountering unforeseen surprises down the road. Think about the investment with trading suites, some costing hundreds or thousands of dollars.

Deciding on a budget allows you to narrow down the software that works within your monetary constraints.

Avoiding Scams in Automation

While we do advocate for automated trading, it’s important to be wary of scams that litter the automated trading landscape. Be on the lookout for red flags such as unrealistic performance guarantees and lack of transparency.

Check on the software providers’ reputations. Review user testimonials and check to make sure they’re real. A reliable provider will be transparent about how their performance claims have been made.

Staying one step ahead of scams doesn’t just mean saving money—it means keeping your investment safe. Keep in mind that about 70% of automated trading strategies go bust because they don’t manage risk properly.

No matter what your strategy, a strong risk management plan is key to succeeding.

Optimizing and Analyzing Performance

When it comes to automated Forex trading, optimizing your trading strategies makes all the difference in producing superior returns. Configuring your system is only half the battle. You’ll have to optimize and iterate on it to get the optimal performance. Making optimization routine helps to actively uncover which strategies are working and where there is room for improvement. This same process is crucial for succeeding in trading.

Optimize Your Expert Advisor

Improving the performance of your EA is similar to tuning a musical instrument for optimal sound. Begin with parameter tuning, modifying settings like stop-loss limits or trade size to better align with the market environment. Strategy refinement is a critical part too, testing and analyzing how your EA would perform in various scenarios.

One of the most powerful tools in this process is backtesting, which consists of running simulations based on historical data. It gives you confidence in how your strategies would have performed in the past and enables you to fine-tune strategies to optimize future performance. Remember though, markets are constantly changing, so you need to change your approach as the market changes.

This newfound flexibility gives you the power to remain adaptive to the latest trends. It’s as much about keeping you out of the over-optimization trap, leading to strategies that only perform well in limited historical conditions.

Analyze Optimization Reports Effectively

Learning how to analyze optimization reports and interpret this data will help you evaluate just how effective your trading strategies are. Look out for important metrics such as drawdown. It shows the peak-to-trough potential loss. Additionally, keep an eye on the win rate, which indicates the percentage of trades that are profitable.

These are metrics that, in aggregate, clearly show how your system is performing. A deeper dive into these reports is essential, allowing you to arm yourself with the best information possible to capitalize on future trades. If a strategy is found to be highly profitable, one should always think about the high drawdown that comes with it.

You should re-evaluate how you approach risk management to protect your capital. Keep in mind that prudent risk management is essential in Forex trading to protect your capital and ensure long-term success.

Value of Optimization in Trading

Optimization is a key driver of smart trading performance and profitability. When you fine-tune your strategies, you make them work harder for you, often generating better returns. As mentioned in a Bloomberg study, automated systems almost always exceed the risk-adjusted return and consistency of manual strategies.

The algorithmic trading market is growing fast and expected to reach $24.9 billion by 2026. To stay on top, in an ever-changing market, successfully optimizing and analyzing performance is more important than ever. Yet, acknowledging optimization is important, it must come with a dose of reality and a warning against endless tuning.

This balance solidifies your strategies, rounding them out to be strong and flexible. It further promotes consistency and discipline in trading, helping to keep emotional biases to a minimum.

Starting Your Journey in Automation

Getting started with automated forex trading can be an understandably intimidating experience. That journey starts with picking the right software. With a plethora of choices available, it’s important to consider software that will suit your technical capabilities and level of comfort.

For instance, if you have a strong background in code, platforms that utilize MQL for MetaTrader may be your best option. These platforms give you access to Expert Advisors (EAs), which are automated trades that can manage your trades for you. All of these options will still require a fair amount of technical know-how to implement, but don’t let that intimidate you.

Understanding how these new platforms operate can unlock tremendous opportunity. Over two-thirds of forex trades are now executed via algorithmic means. This new trend brings the increased trend and reliability of automation to the forefront of trading.

So, beyond selecting the software you’ll use to implement automated trading, it’s important to have clear goals and strategies in mind. Automated trading software works best when it’s used in conjunction with a clear strategy. Learn the strategy behind the tool you’re using to unlock its full potential.

This means determining what levels of risk you want to take, what trading pairs you want to use and how often you want to trade. Specific goals will inform what you need to set up in your software and keep you focused on the big picture. Keep in mind, the software is just one tool in your trading arsenal.

It is key to understand the fundamentals of Forex trading and develop your skills in tandem with utilizing these tools. Taking this dual approach will deepen your comprehension and keep you feeling comfortable and competent in your trading activities.

Automated trading might be one of the best paths to capitalize on that growth and learning. In just a few minutes, you can familiarize yourself with the fundamentals of Forex trading. This platform allows you to hone your skills as a trader before you scale up to more advanced strategies.

The automated process removes the emotional factors involved, which is the biggest obstacle in manual trading. This frees you up to focus more on strategy and analytics. With every time you log into these platforms, you will be faced with different tactics and market environments, each providing you a learning opportunity.

It’s important to be careful when buying from third-party sites. Protect the integrity of the software to not be swindled by losing algorithms sold under fraudulent pretenses.

Conclusion

Once you start to discover the world of automated forex trading, the possibilities are endless. These tools provide an innovative approach to interact with the market, combining technology and tactics. Forex robots are able to execute trades in the blink of an eye. As a result, this technology has leveled the forex trading playing field for accomplished traders and novices. Selecting the proper software is important, but it’s vital to test and optimize the software to get the most bang for your buck. Enter the automation space prepared, ready to explore with the best interests of your agency in mind. Be on the lookout, be smart, and be ready to adjust. If this is your first step into the world of automated trading, welcome and know that the possibilities are endless. Want to join us on the next step of our journey? Join us on the cutting edge of trading, and take it for a test drive today.

Frequently Asked Questions

What is automated forex trading?

Automated forex trading employs computer programs to buy and sell currencies according to predetermined criteria. It removes emotional trading and gives the ability to trade 24/7. It’s perfectly suited for traders who want to be completely hands-off.

How do forex robots work?

Forex robots are powered by algorithms in order to scan massive amounts of market data and automatically execute trading decisions. They can be programmed to perform trades based on technical indicators or other pre-defined strategies, allowing them to execute trades automatically without human intervention.

What are the benefits of automated forex trading?

Automation removes emotions from trading, ensures consistent strategy execution, and allows traders to capitalize on market opportunities around the clock. It’s fast and allows you to backtest your strategies.

What are the drawbacks of using forex robots?

Another point to consider is that forex robots can easily overfit historical data which will result in poor performance going forward. They need constant oversight and are expensive. Market conditions are subject to change, at times making these tools less effective.

How do I choose the right trading software?

Go with software that has a history of success, an intuitive platform, and excellent customer service. Be sure it matches up with your overall trading strategy and risk tolerance. Do your homework, check online reviews, and try out a demo account first.

How do I install and configure a forex robot?

Another important thing to consider is that most forex robots are packaged with installation instructions. Generally, you would download the software, install it on your trading platform, and set up various settings to reflect your trading strategy. So it is extremely important to read directions thoroughly and completely.

What should I consider when evaluating trading software?

Look into the software’s historical performance, user-friendliness, and whether it works with your existing trading platform. Seek transparency when it comes to results and reliability of the software. Simulated trading on a demo account is a vital step before moving on to live trading.